Did that Goal Hit the Stock Market?

Do Behavioural Finance and Football make a good cocktail? A unique take on Brazil’s economy from a hardcore stock trader. Kaushik Saha correlates the market movement in the football crazy South American nation with its performance on the field. You may reach him on Twitter: @kaushiksaha1982

This article is meant to be written in humour, with some truth at some places maybe. Don’t expect the editors to give it a go-ahead, but if you are reading this, the article is not exactly waste-paper basket stuff…

Behavioural finance and economics are fascinating aspects of the respective fields of study. Several economists including the likes of Adam Smith and Vilfredo Pareto have done seminal work in this domain. As a student, I was taught that stock markets are predominant examples of bandwagon effect and optimism bias, and are indicators of the mood of a significant section of a country’s population.

So one day, bored with work I tried to engage in some mental jugglery and tried to correlate the beautiful game with the markets. The article could have dealt with cricket, or baseball, or rugby and the respective countries majorly associated with these sports. But this is about football, the game we hold so dear to our hearts. And the fact that it is the most viewed and followed game in the world, makes it the subject of a fascinating case study.

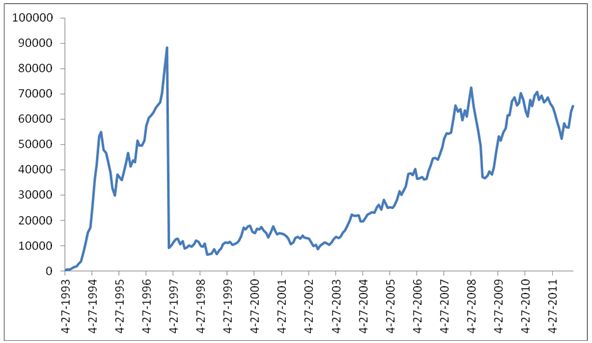

The first country that comes to mind is Brazil. Brazil, according to Goldman Sachs is one of the hot-shot emerging economies, part of so-called BRICS. BOVESPA is their index. It commenced in the financial year 1993-94, and this is the graph of BOVESPA closing values.

Now let me propose my “theory”. Brazil is an economy populated by people who are very passionate about their sports. When their football team does well they sing, dance, celebrate and reach heights of happiness. The whole country is in a positive mood, and this reflects in the way they invest in the markets and the dealers go bullish on the asset classes. This leads to a surge in their stock market indices. Now, Brazil being an emerging market, its market movements are not just guided by sentiments of domestic investors. The foreign investors have a big role to play and Brazil’s economy is hurt by global negative sentiments like the 1997-1998 East Asian and the 2008 sub-prime crises.

But even in the bleak years when the market has seen sudden falls, there are days and weeks where there have been surges, the sentiments have been bullish and markets have ended on the green. A closer look at these bull-runs will see them coincide with the good or great results in football.

For example, take the great bull run of 1994 which peaked at around August 1994. What happened just a month back? Brazil won the 1994 FIFA World Cup after 24 years!! Even in early 1997, before the East Asian crisis struck, and took down the East Asian Tigers and South American countries like Brazil and Argentina, the bull-run came after a Copa America victory.

Then came the great crash, which nearly wiped out the Brazilian economy and the recovery was slow and painful. However, even in those bad times, the consistent rise in BOVESPA in the second half of 1999 leading to an annual appreciation of nearly 60 percent followed yet another Copa America win.

The 2000s have been a happy decade for Brazil football fans; 2002 World Cup win, 2004 and 2007 Copa America wins, 2005 and 2009 Confederation Cup wins have all been part of the consistent rise of the Brazilian economy. Yes, Jim O’Neill, the Goldman Sachs banker who coined the term in the first place did speak of BRICs and Brazil had all the fundamental factors in place to grow, just like Russia, India and China; but macro analysis of the above mentioned years and tournaments will quite support the theory.

Brazil’s economic growth story dealt another blow by the 2008-09 sub-prime crises, like most major and emerging economies. And it recovered too, like most others. But below par performances in 2010 World Cup and 2011 Copa America (both QF losses), haven’t done anything to break away from the range-bound markets.

There are several other factors that affect stock market data, of course, and this is just a theory that I am proposing. But the underlying fact that cannot be taken away is that sports affect a majority of us in one way or the other, despite the fact that a few of us have never played any at a serious level. This was my humble way of paying tribute to the two things I hold dearest – my passion and my profession.

Good one. But I expected a sharp spike in 2002 as the euphoria of WC win was much more than in 1994. For Brazilians it’s not just winning that matters, but how they win.